Roth conversions are a powerful tax planning strategy, but how do retirement savers actually use them? A recent survey of Boldin subscribers reveals that users are not only highly engaged in Roth conversion planning but also taking meaningful action based on Boldin’s tools and insights.

The results show that 89% of respondents have used Boldin’s Roth Conversion Explorer or Money Flows tools to evaluate conversion strategies, with the majority developing multi-year plans to optimize their tax efficiency. Additionally, 83% of users say they have either taken action or plan to do so in 2025.

Below, we break down six surprising takeaways from the survey:

An overwhelming majority (89%) of respondents indicated they had used Boldin’s tools to strategize Roth conversions, with 49% using the Roth Conversion Explorer and 36% utilizing both the Explorer and Money Flows.

Only 6% reported not using these tools, while 1% were unsure.

The Roth Conversion Explorer and assessing Roth conversions in Money Flows are ways to assess the impact of this financial strategy against your current and projected financial situation.

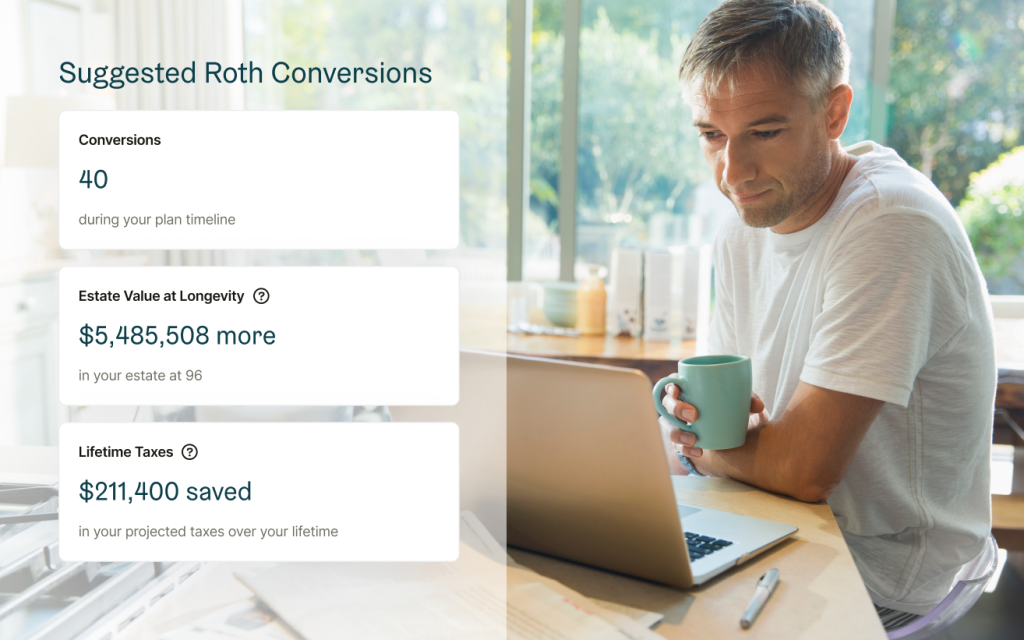

- The Explorer runs a highly sophisticated algorithm to evaluate numerous potential Roth conversion strategies, aiming to identify the most effective approach based on your specified goals, future economic assumptions, and your personal financial parameters. Users can evaluate the suggested plan and compare it against all of their financial metrics through scenario comparisons.

- In Money Flows, a user can model specific Roth conversion amounts in desired years and assess the impact on a wide variety of financial metrics including their lifetime tax liability and net worth at retirement and at longevity.

2. Boldin Users Develop Complex Roth Strategies, Spanning Multiple Years

Boldin users are seeking sophisticated multi-year strategies when considering Roth conversions. A full seventy-one percent of subscribers use the tools to develop a plan for conversions over multiple years while another 24% incorporated both a current-year and multi-year approach.

Only 4% of respondents focused solely on the current year, underscoring the importance Boldin users place on long-term tax planning.

There is variation on the period of time over which conversions are spread out:

- Fifty percent of users who plan a multi year conversion strategy plot their conversions over a 5-10 year period

- Twenty six percent plan for a 2-4 year time period

- Fifteen percent plan for a 11-15 year time period

- Nine percent plan for 16 years or more

3. Roth Conversion Planning is a Financial Habit, Not a One-Time Action

When asked about how frequently they used Boldin’s Roth Conversion Explorer, 76% stated they leveraged it multiple times throughout the year, 11% checked it at the beginning of the year, and 4% run the tool only at the end of the year.

Boldin’s coaching and support staff report that users run the tool on a frequent basis, using the “apply to plan” feature to create multiple scenarios as a decision making tool prior to performing Roth conversions.

Beyond modeling, many respondents had either already taken action or planned to execute a Roth conversion soon. A full 83% of respondents say that they have taken action or plan to take action in 2025 based on information they gained from using the Boldin Roth conversion functionality.

Timing for when conversions are performed varies: There are different schools of thought for when to do conversions.

- Forty-two percent of Boldin users preferred to convert once a year at the end of the year

- Waiting until the end of the year may allow users to better estimate the ideal conversion amount if they’re managing tax brackets, IRMAA brackets, or other thresholds.

- Thirty-five percent of respondents spread conversions throughout the year

- Users may perform multiple conversions throughout the year as share prices change and they have more detailed information regarding their annual income relative to any brackets or thresholds they are trying to manage. One rationale for converting earlier in the year is that converting when share prices are low may allow users to convert more shares for fewer dollars.

- A smaller group, 14%, took action at some time mid-year.

- Performing conversions mid year may indicate that users have enough confidence in the year’s numbers to take action.

- Ten percent converted at the beginning of the year

- Because converting when share prices are low may allow users to convert more shares for fewer dollars, performing conversions at the beginning of the year can prove beneficial if/when share prices increase later in the year.

Why a few aren’t taking action

Among those who chose not to take action on Roth conversions, the most common reason (30%) was uncertainty about whether a conversion would be beneficial. Others cited an inability or unwillingness to pay taxes on the conversion (15%), plans to seek financial advice before proceeding (12%), or other personal factors (42%).

5. Goals for Conversions Varies

Wise strategizing for Roth conversions demands that you set a primary goal for making the conversions. And, the survey reveals that the reasons for conversions varies:

- Thirty-two percent were aiming to reduce their lifetime tax liability

- Thirty percent wanted to stay below a specific tax bracket

- Only 20% were striving to improve their estate

- And, a mere 6% were trying to minimize IRMAA

Confidence levels in Roth conversion strategies were generally high among users. Over half (55%) expressed moderate confidence that their plan would improve their financial outlook, while 27% were highly confident. However, 18% remained uncertain about the impact of their Roth conversion strategy.

And, Boldin’s Roth conversion functionality received strong approval, with 82% of respondents reporting satisfaction (65% satisfied, 17% very satisfied). However, 14% indicated they were not satisfied, highlighting potential areas for further refinement.

Conclusions

The survey results illustrate that Boldin users are highly engaged in Roth conversion planning and value the ability to model their strategies over multiple years. Confidence levels in Boldin’s tools remain strong, with the majority of users satisfied with their functionality.

How the survey was conducted

The Boldin User Survey was conducted to gain deeper insights into how PlannerPlus subscribers utilize Roth conversion functionality and the impact it has on their decision-making processes. The survey was distributed to active Boldin users who logged into the Planner on the morning of Friday, February 28, 2023.

A total of 208 users participated in the survey, providing data on their Roth conversion strategies, frequency of use, and satisfaction with the platform’s features. Ninety-two percent of respondents were bewtewen the ages of 50-69 years old (36% were 50-59 and 56% were 60-69).

To ensure the accuracy and reliability of the data, responses were anonymized and aggregated.

The findings from this survey offer a valuable snapshot of how Boldin users approach Roth conversions, highlighting trends in multi-year planning, timing preferences, and confidence levels in financial decision-making. These insights will help Boldin further refine its tools and educational resources to better serve users in optimizing their retirement strategies.

More About the Boldin Planner and Roth Conversions

The Boldin Planner is powerful software that puts you in control. It’s almost like having a financial expert at your fingertips. Research shows that people with a written financial plan do 2.7 times better financially. They’re also 54% more likely to live comfortably in retirement. That’s not luck, that’s taking control of your money. The Boldin Planner has been named the Best Financial Planning Software of 2025 and the company was selected as a Top Innovator in UpLink’s Prospering in Longevity Challenge and named to the FinTech 100 by CBInsights.

And, here are some additional information about Roth conversions: