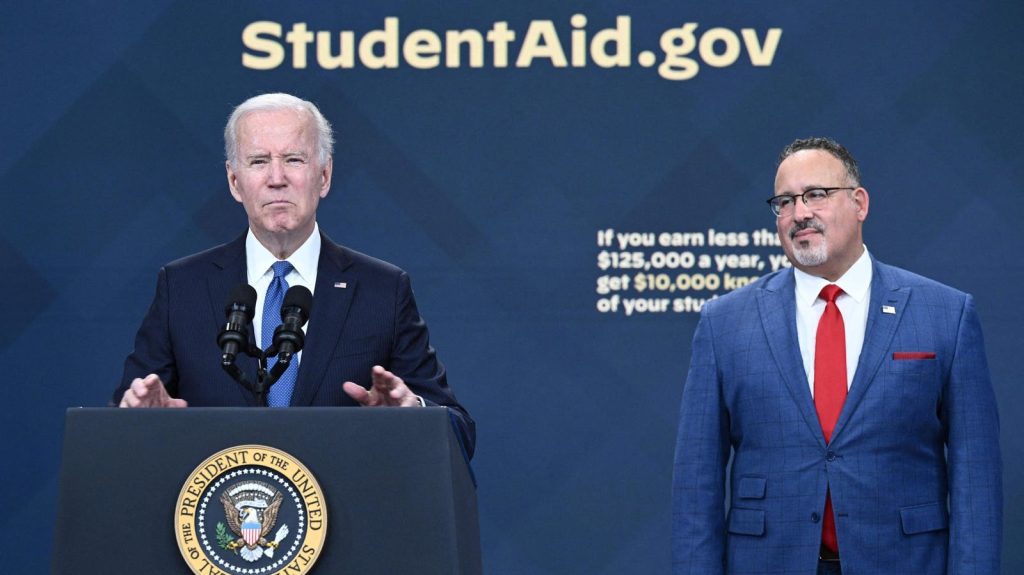

US Education Secretary Miguel Cardona (R) looks on as US President Joe Biden delivers remarks on the … [+]

After years of delay, the Education Department has finally launched a new application that could provide a pathway for a small but overlooked group of borrowers seeking student loan forgiveness.

Joint federal consolidation loans (also known as spousal consolidation loans) were available to married borrowers until 2006. The program allowed married borrowers to join their individual federal student loan balances into a single, combined federal consolidation loan. But the program led to serious problems for these borrowers, particularly if they got divorced or separated, or if they wanted to pursue certain federal student loan forgiveness programs.

Two years after Congress passed legislation allowing for the separation of these loans, the department has finally launched an official application.

Joint Consolidation Loans Caused Complications For Repayment And Student Loan Forgiveness

The joint spousal consolidation loan program was designed to make student loan repayment simpler for married borrowers. By combining their balances into one, a married couple might have an easier time managing their student loan payments than if they each had multiple loans with different billing amounts, all handled by several distinct loan servicers.

But problems arose because the loans could not be separated. If the couple got divorced, the ex-spouses remained jointly responsible for the entire loan balance. That meant that if one person decided not to pay, the other would still be liable. This could be troubling for many borrowers and outright dangerous for others, such as people who were at risk of domestic violence.

In addition, monthly payments under any income-driven repayment plan would have to be based on the combined income of both ex-spouses. This would be true even if they got divorced and remarried. That could make those payment plans completely unaffordable.

In some cases, joint spousal consolidation loans prevented borrowers from pursuing student loan forgiveness programs. For example, joint consolidation loans issued through the older FFEL program needed to be re-consolidated into a Direct loan to qualify for programs like Public Service Loan Forgiveness and the new SAVE plan. But federal law prevented the separation of joint consolidation loans, blocking relief for FFEL borrowers through these loan forgiveness pathways.

Congress Passed Law To Separate Joint Consolidation Loans

Two years ago, Congress finally passed legislation allowing borrowers to separate their joint consolidation loans.

“On Oct. 11, 2023, the Joint Consolidation Loan Separation Act (JCLSA) was signed into law to allow joint consolidation loan borrowers to separate their joint loan obligations and reconsolidate into new individual Direct Consolidation Loans,” says Education Department guidance. “This new law will allow borrowers struggling with their joint consolidation loans to receive significant benefits previously unavailable to them.”

But the passage of the statute had no immediate impact for those who were looking to separate their joint consolidation loans. The Education Department still needed to come up with a process for actually implementing the separation. For two years, these borrowers remained in limbo as several Biden administration student loan forgiveness initiatives — such as the Limited PSLF Waiver, the IDR Account Adjustment, and the launch of the new SAVE plan — came and went.

New Application Allows Consolidation Separation And Access To Student Loan Forgiveness Programs

Just weeks ago, the Education Department finally launched an application that allows borrowers to separate joint consolidation loans.

“Starting on September 30, 2024, JCL borrowers may request a JCL separation by submitting a Combined Application to Separate a Joint Consolidation Loan and Direct Consolidation Loan Promissory Note (App/Note),” said an Education Department bulletin issued on October 1. “The App/Note is available to all DL and FFEL borrowers as a downloadable paper application.”

By separating the loans, borrowers will be eligible for certain federal student loan forgiveness programs, even though some key deadlines have passed.

“Direct Joint Consolidation Loan borrowers will receive the one-time IDR account adjustment when it occurs,” says department guidance. “These borrowers will also be credited with any earned progress toward PSLF forgiveness based on this account adjustment if they meet all other PSLF requirements.” In addition, “Federal Family Education Loan (FFEL) Program Joint Consolidation Loan borrowers who take the necessary steps to separate their loans will receive the benefit of the one-time IDR account adjustment even if the application does not become available until after the adjustment occurs in 2024. The adjustment will be applied retroactively for both borrowers when both applied to separate their joint consolidation loan.” These borrowers can also receive student loan forgiveness credit through PSLF if they properly certified their qualifying public service employment.

“Additionally, ED has stored a record of the joint consolidation Loan borrowers who took the steps outlined to express interest in the Limited PSLF Waiver prior to Oct. 31, 2023,” continued the department. “We will reach out to those borrowers in a separate communication at a later date to confirm that their PSLF-eligible payment counts will be adjusted to reflect the terms of the Limited PSLF Waiver retroactively after the borrower takes the steps to separate their loans.”

How The New Student Loan Application To Separate Joint Consolidations Will Work

According to the Education Department bulletin, the implementation of the separation will happen in phases.

First, borrowers must submit the application. They will have the option of completing a joint application — where both borrowers agree to separate the loan — or a separate or individual application. Borrowers can submit a separate or individual application if they “have experienced domestic violence by the other co-borrower; have experienced economic abuse from the other co-borrower; or are unable to reasonably access the other co-borrower’s loan information.”

“The App/Note will be processed and validated within 10 business days by the Consolidation Originator which manages the Consolidation Loan origination process for the Department,” says the bulletin. However, it’s unclear if processing has actually begun, and if not, when that will happen.

Second, “After the process outlined above, the Consolidation Originator will separate the borrower’s JCLs and re-consolidate them into individual Direct Consolidation Loans,” according to the bulletin. The department will follow up with applicants if any information is missing on the application.

The Education Department has not actually begun separating joint consolidation loans (which it refers to as “Phase II” of the process). “The Department will update borrowers who submitted the App/Note when Phase II begins,” says the bulletin.