Federal Reserve Chair Jerome Powell said Thursday that strong U.S. economic growth will allow policymakers to take their time in deciding how far and how fast to lower interest rates.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell said in remarks for a speech to business leaders in Dallas. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

(Watch Powell’s remarkets live here.)

In an upbeat assessment of current conditions, the central bank leader called domestic growth “by far the best of any major economy in the world.”

Specifically, he said the labor market is holding up well despite disappointing job growth in October that he largely attributed to storm damage in the Southeast and labor strikes. Nonfarm payrolls increased by just 12,000 for the period.

Powell noted that the unemployment rate has been rising but has flattened out in recent months and remains low by historical standards.

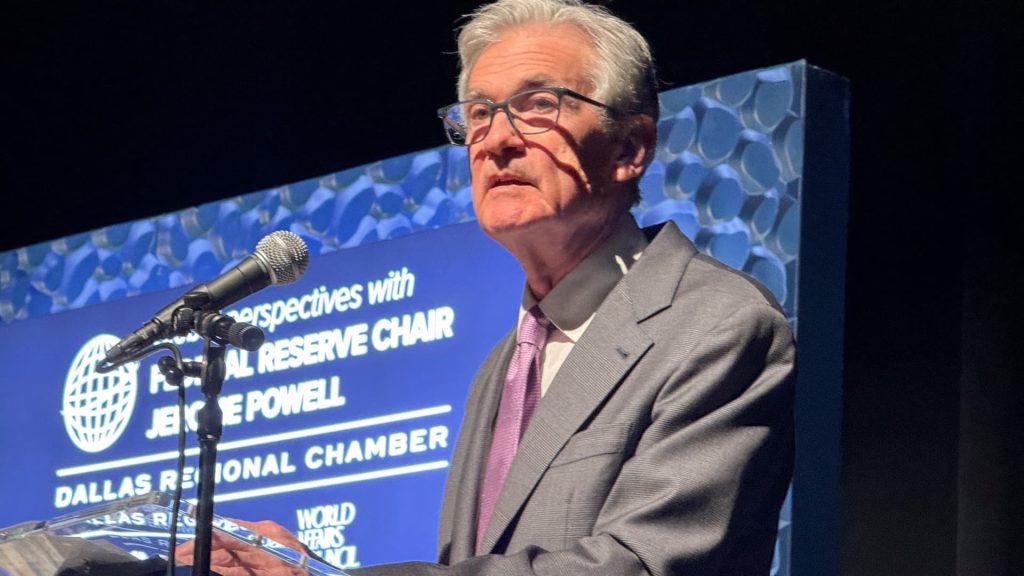

Federal Reserve Chair Jerome Powell delivers remarks in Dallas on Nov. 14, 2024.

Ann Saphir | Reuters

On the question of inflation, he cited progress that has been “broad based,” noting that Fed officials expect it to continue to drift back toward the central bank’s 2% goal. Inflation data this week, however, showed a slight uptick in both consumer and producer prices, with 12-month rates pulling further away from the Fed mandate.

Still, Powell said the two indexes are indicating inflation by the Fed’s preferred measure at 2.3% in October, or 2.8% excluding food and energy.

“Inflation is running much closer to our 2 percent longer-run goal, but it is not there yet. We are committed to finishing the job,” said Powell, who noted that getting there could be “on a sometimes-bumpy path.”

Powell’s cautious view on rate cuts sent stocks lower and Treasury yields higher. Traders also lowered their expectations for a December rate cut.

The remarks come a week after the Federal Open Market Committee lowered the central bank’s benchmark borrowing rate by a quarter percentage point, pushing it down into a range between 4.5% and 4.75%. That followed a half-point cut in September.

Powell has called the moves a recalibration of monetary policy that no longer needs to be focused primarily on stomping out inflation and now has a balanced aim at sustaining the labor market as well. Markets still largely expect the Fed to continue with another quarter-point cut in December and then a few more in 2025.

However, Powell was noncommittal when it came to providing his own forecast. The Fed is seeking to guide its key rate down to a neutral setting that neither boosts nor inhibits growth, but is not sure what the end point will be.

“We are confident that with an appropriate recalibration of our policy stance, strength in the economy and the labor market can be maintained, with inflation moving sustainably down to 2 percent,” he said. “We are moving policy over time to a more neutral setting. But the path for getting there is not preset.”

Powell added that the calculus of getting the move to neutral rate will be tricky.

“We’re navigating between … the risk that we move too quickly and the risk that we move too slowly. We want to go down the middle and get it just right so that we’re providing support for the labor market but also helping enable inflation to come down,” he said. “So going a little slower, if the data let us go a little slower, that seems like a smart thing to do.”

The Fed also has been allowing proceeds from its bond holdings to roll off its mammoth balance sheet each month. There have been no indications of when that process might end.