I got to thinking the other day that Trump’s plan to lower mortgage rates might be through increased unemployment.

While everyone is seemingly focused on the other side of the coin, inflation, maybe it’s the wrong place to look.

We’ve been talking about tariffs and deportations when maybe we should be talking about all the jobs being eliminated in Washington and beyond.

Remember, the Fed’s dual mandate is price stability and sustainable employment.

If we see a surge of layoffs, which we’re already seeing, the Fed could be forced to act.

DOGE Says Call My Bluff on Government Layoffs

When Trump was running for his second term, he promised to reduce federal spending and the size of the federal government.

Helping him fulfill this difficult mission was Elon Musk, who ironically unveiled the “Department of Government Efficiency,” or DOGE for short.

If you need some quick background on that, it’s basically a play on the longstanding Doge meme, which is a Shiba Inu dog that emerged in the early 2010s.

The real-life dog named Kabosu was pictured with silly, broken-English text overlays that used modifiers like “such” and “much.”

For example, if I were to create one (which I just did above) for what’s going on with all these job cuts, it might say something “much layoffs,” “such unemployment,” and “wow.”

And while it’s all totally absurd on the surface, it all got very real when the layoff announcements came streaming in.

The DOGE government organization launched about a month ago and it’s been nonstop government layoffs ever since.

Meanwhile, the tariffs we all feared would drive inflation we’re largely put on hold, other than China’s.

So perhaps we should focus on jobs (sustainable employment) instead of inflation (price stability) when looking at the overall economic picture.

Thousands of Government Layoffs and Buyouts Have Already Taken Place, with More to Come

While it’s unclear just how many government jobs have been extinguished, either through layoffs or buyouts, it’s not a small number.

And it doesn’t appear to be over either. If we simply consider buyouts, roughly 75,000 federal workers accepted the deferred buyout program, per the U.S. Office of Personnel Management.

At the same time, thousands of government employees have been terminated at a variety of high level agencies, including the Department of Energy, the Department of Education, EPA, and many others.

Then there’s the near-shutting down of the CFPB, mass firings at the IRS, and the 1,000+ job cuts at the Department of Veterans Affairs (VA).

Oh, and news that half of the staff at Department of Housing and Urban Development (HUD) have been let go.

In other words, the DOGE initiative is very real and the fallout is going to be big. We have no idea just how big yet, but it’s clear a lot of jobs are being lost.

There are reportedly 2.3 million civilian workers in the federal government and it appears many are being targeted in one way or another.

On top of that, there is attrition, where government workers leave voluntarily or quit, perhaps in a form of protest.

I actually know an individual who has decided to leave. At some point, all of this is going to show up in the employment data.

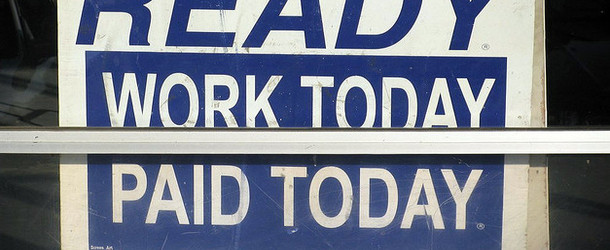

And if you weren’t aware, the jobs report can impact mortgage rates in a major way.

Long story short, the bleaker the job picture, the lower mortgage rates tend to go, as it signals a weakening economy and perhaps cooler inflation.

Trump Isn’t Relying on the Fed, But Might Force Their Hand Anyway

That brings us back to the Fed. While newly-appointed Treasury Secretary Scott Bessent said last week that Trump isn’t going to ask the Fed to lower rates, it could go that way anyway.

While he said Trump was focused on the 10-year bond yield, which correlates well with 30-year mortgage rates, the Fed may still be forced to act.

If the unemployment rate increases significantly as a result of all the government job losses, the Fed may need to recalibrate its monetary policy. It could also throw off their “soft landing.”

And though there’s not a direct effect of Fed rate cuts on long-term mortgage rates, they do tend to share a directional component.

In other words, if the Fed is cutting more due to a deteriorating economy, chances are 10-year bond yields will be falling as well, likely before the Fed cuts.

This would indicate lower mortgage rates prior to the Fed getting around to cutting, and in the process, would be a roundabout way of achieving the goal of lower interest rates for consumers.

Of course, it would be at the expense of potentially millions of government jobs, for which it’s unclear if there would be a replacement.

So in the end, the 30-year fixed might trickle down to the low-6s or even high-5s this year if that happens, but not without serious economic fallout.

It also makes you wonder what will happen in areas with a high concentration of government workers, such as in and around Washington D.C.

I’ve already heard that for-sale listings have jumped up, though we’ll need more time to see how real that story is.

But it could hurt local housing markets, assuming these homeowners up and leave.

However, one might question where they’d go if they already have the best deal in town in the way of a 2-4% 30-year fixed-rate mortgage.

Read on: 2025 mortgage rate predictions