“Evaluating your life through the lens of your death is raw, powerful, and perhaps a bit scary,” writes author and entrepreneur, Shane Parrish, in his excellent book, Clear Thinking. But despite our hesitation to consider our inevitable demise, he thinks it’s worth exploring because, “What matters most becomes clear.”

Begin with the end in mind.

Clarity around what matters most is the missing ingredient in most financial planning. We get stuck micromanaging means without considering, discerning, and articulating the ends. We get stuck thinking there is inherent value in a masterfully allocated portfolio, a brilliantly written will, a perfectly placed insurance policy, a meticulously prepared tax return, or the arrival at a particular number that reflects our net worth. But there’s not.

All those things matter, but only because they serve what matters most.

Here’s how the writer of the wisdom literature of Ecclesiastes put it, attributed to King Solomon, likely the world’s richest person, in the 10th century BC:

“Yet when I surveyed all that my hands had done and what I had toiled to achieve, everything was meaningless, a chasing after the wind; nothing was gained under the sun.”

In other words, you can’t take it with you. Or the more visual colloquialism, you never see a U-Haul behind a hearse.

Therefore, as productivity guru Stephen Covey taught us, we must begin with the end in mind.

But how do we do that? How do we know what matters most?

There are many exercises that can help illuminate what matters most, but here I’ll offer two that I have found to be the most helpful—a 5-minute version and a 50-minute version.

The 5-minute exercise involves answering 2 questions:

- What concerns you? What are the doubts, hesitations, or fears that keep you up at night?

- What aspirations do you have? What are the hopes, dreams, and aims that drive you?

Taking even five minutes to answer these questions will likely generate a substantive list once you get rolling, so here’s how you can limit that longer list to a practical prescription for your life and financial planning. As you consider your concerns, in particular, cross out anything that you can’t control.

For example, with the political machine excelling monumentally at instilling every imaginable fear amongst us, the voters, at this time, it’s altogether likely that some fears related to the outcome of this and future elections are top of mind. Yet despite that simple, single act of casting our respective votes, there is very little we can do to control the outcome of the next presidential election.

However, maybe you listed concerns about your spouse or partner, your children or grandchildren, your present spending or your future provision, your health and wellness, your work, your lifestyle in retirement, or maybe you listed a cause or causes to which you are (or would like to be) directly connected. These things matter to you, things worthy of your intentions in financial planning.

Now, for each of the concerns you have listed, I’d like you to consider that it represents one side of a coin. So, what is the aspiration on the other side of that coin?

We start with concerns because our brains tend to amplify shorter-term threats to our health and happiness relative to our longer-term aspirations—but there is almost always a connection.

For example, you’re concerned about your high cholesterol reading because you aspire to enjoy an active lifestyle. You’re concerned about the skyrocketing cost of college education because you aspire to see your grandchildren succeed in life. You have concerns about the Fed’s handling of inflation (which you can’t control) because you aspire to live a life of abundance with financial freedom.

From this exercise, you’ll arrive at a handful of bullet points that can act as markers of meaning in your financial life planning. They can stand alone as pillars of your planning, or you may helpfully weave them together as a financial mission statement of sorts. A true north on your planning compass to which you can refer to ensure that the ultimate ends justify the means you’re managing.

At my company, we refer to this as our clients’ (and our own) Net Worthwhile®. It looks different for everyone, but it’s effectively a completed sentence that begins thusly:

“The purpose of my wealth is…”

Now, why would you consider a 50-minute exercise when you’ve achieved so much in five? Well, this next exercise goes even deeper and regularly delivers proportionately greater ROI. In addition to requiring more time, it also requires more courage because it forces us to more directly address the ultimate end that Shane Parrish raised—our death.

These questions were carefully crafted by the financial advisor and thought leader who led the movement known as life planning within the broader practice of financial planning, George Kinder. While these questions are often best navigated with an advisor trained (as I’ve been) to pose and process them with you, I’m sharing them here with permission from the Kinder Institute of Life Planning to illustrate the power of death in financial life planning.

I’d recommend you set aside an hour, grab your favorite beverage, and position yourself in a place of silence and solitude, and then consider…

The 50-minute exercise involves answering George Kinder’s 3 Questions:

Question #1:

I want you to imagine that you are financially secure, that you have enough money to take care of your needs, now and in the future. The question is…how would you live your life? Would you change anything?

Let yourself go. Don’t hold back on your dreams. Describe a life that is complete, that is richly yours.

Question #2:

This time you visit your doctor who tells you that you have only 5 – 10 years left to live. The good part is that you won’t ever feel sick. The bad news is that you will have no notice of the moment of your death. What will you do in the time you have remaining to live?

Will you change your life and how will you do it?

Question #3:

This time your doctor shocks you with the news that you have only one day left to live. Notice what feelings arise as you confront your very real mortality. Ask yourself:

What did I miss/ Who did I not get to be? What did I not get to do?

These questions aren’t easy, but they are enlightening. With these questions answered, you’ve almost surely identified what matters most, your Net Worthwhile®, the guideposts that help ensure your financial plan is in service of your life plan, and not the other way around.

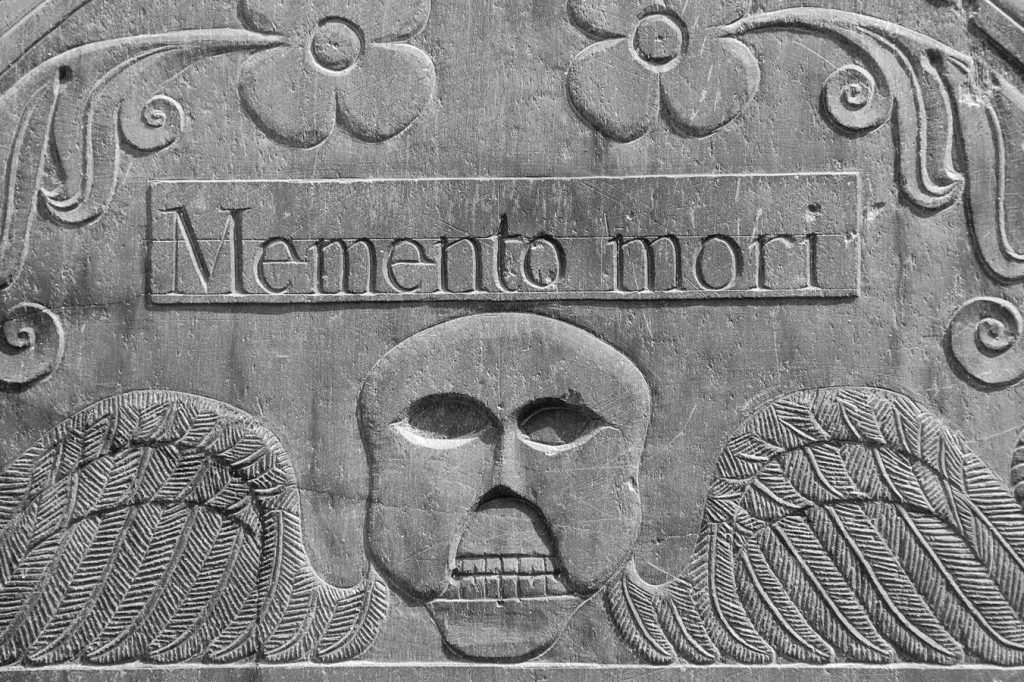

Shane Parrish writes, “Wisdom is turning your future hindsight into your current foresight.” It reminds us of the Latin phrase popularized by stoic philosophy, “Memento mori” – remember you will die.

And we need not view this reminder as morose. If the objective is to begin with the end in mind, and our eventual passing is the ultimate end, then that should inform how we live and how we plan.

That is wisdom.