I wanted to take a moment to talk about the types of sellers that exist in the housing market.

There are typically two types of sellers: would-be seller and must-sell sellers.

The first group are folks who would sell their property, but only for the right price.

And the second group consists of motivated sellers who must sell, even if the price isn’t right.

Let’s discuss why this is important and how it impacts the housing market.

What Is a Would-Be Home Seller?

As the name suggests, a “would-be seller” is a homeowner that is interested in selling their property, but only if the conditions are right.

Typically, this means they’ll only part with the property for the right price. And that right price is usually a high price.

For example, you might see a home listed for $500,000 in a neighborhood where most other properties are selling for say $450,000.

This is usually the first clue. The price is higher than comparable properties. Another way of looking at this type of seller is that they’re simply not motivated.

They threw their property on the MLS to see if there were any takers. There’s a good chance they’re not that serious.

It’s almost the equivalent of the looky-loo home buyer who tours open houses just to be nosy, often with little intention of making an offer.

The would-be seller is like this and isn’t too fussed if their property sells or not.

Often, they go against the listing agent’s wishes by listing the property for “too much money.”

And this type of property languishes on the market, often for months if not years in some cases.

The Must-Sell Seller Is Motivated

Conversely, we have the “must-sell seller,” which is the complete opposite of the would-be seller.

This individual needs to sell their home, and fast. They don’t have time to mess around and list high.

The property should be listed competitively, and the seller should be willing to entertain things like seller concessions and repair requests.

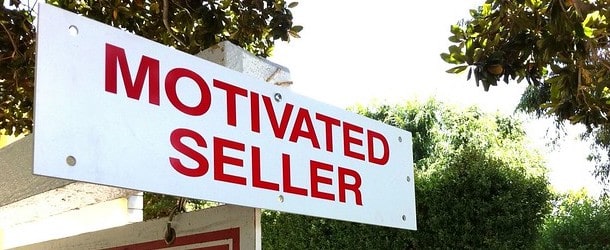

The best way to sum up this type of home seller is the word “motivated.” In fact, you might even see the phrase “motivated seller” in their property listing or on their yard sign!

A home buyer should favor this type of seller because they’ll be much more willing to negotiate.

And the starting point for their list price should also be more reasonable.

For example, if recent comparable sales in the neighborhood were $450,000, chances are they’ll list at a similar price. Or even lower!

The best way to sum it up is the property is “priced to sell.”

Today’s Housing Market Is Dominated by Would-Be Sellers

Now taking into consideration those two definitions of home sellers, I’d argue that in most markets nationwide, we have a lot of would-be sellers.

Why? Well, if you look at what sellers are trying to sell for versus what buyers are willing to pay, there’s often a big gap.

You’re hearing a lot of prospective buyers say “that’s too much” or “I’m not willing to pay that.”

But the thing is, many of the folks who have listed their properties “too high” don’t really care. They’re not motivated sellers.

They’re simply throwing their properties on the market to test the waters. In their mind, if someone offers them full list or close to, they’ll go with it.

If not, well, who cares. Just let it sit and bide your time. There’s no rush.

What this means for the housing market is that despite poor affordability, home prices continue to go up.

The CoreLogic S&P Case-Shiller Index showed that prices increased 4.25% year-over-year in August, though the rate of appreciation has slowed for a fifth consecutive month.

And home prices gains are expected to cool further, with just a 2.3% annual gain expected by next August. However, prices keep rising…

Low Supply and Cheap Mortgages Allows Sellers to Be Patient

A continued low supply of existing homes has kept home prices on the up and up.

But the rate of appreciation has slowed and you can blame both high mortgage rates and high home prices for that. However, and most importantly, home prices aren’t falling, at least nationally.

This lack of affordability could eventually lead to actual price declines, especially in overcooked markets, but it will depend on the type of seller that dominates the market.

For comparison sake, in the early 2000s mortgage crisis, the market was saturated with must-sell sellers.

Many couldn’t (or didn’t want to) make their next mortgage payment, often because it was an adjustable-rate mortgage or they qualified via stated income and could never really afford it to begin with.

Today, you have a home seller with a very low, fixed-rate mortgage who might want to sell, but isn’t at all desperate.

Until that changes, I wouldn’t expect home buying conditions to change much.